Bad Debts Written Off Journal Entry

Suppose the amount due from a customer is Rs. Journal Entry for Recovery of Bad Debts.

Writing Off An Account Under The Allowance Method Accountingcoach

Instead it is reported at its full amount with an allowance for bad debts listed below it.

. Provisions for bad debts at 2 of this amount would come to 5600. Vii Goods of 1000 given as. In the next financial year the debt becomes bad debt which needs to be written off.

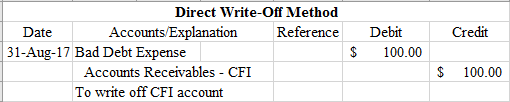

Bad debts actually written off in the year are 5420. The recovery of a bad debt like the write-off of a bad debt affects only balance sheet accounts. 1 Direct Write-Off Method.

Debtors at the end of the year are 350000. While posting the journal entry for recovery of bad debts it is important to note that it is treated as a gain to the business that the debtor should not be credited as in. Debtors at the end of the year are 280000.

In the journal entry it debits bad debt expenses while crediting the amount it expects to be paid. Partially or fully irrecoverable debts are called bad debts. Since its founding in 1936 JM has played a significant role in shaping the content and.

Explanation of Provision for Bad Debts. Above we assumed that the allowance for doubtful accounts began with a balance of zero. The amount that is written off depends on the net amount of the marked transactions.

So the firm does not want to write off the sum for the time being. When a customer pays after the account has been written off two entries are required. The write-off transaction is created in a general journal and can contain up to three types of journal.

Bad debt is usually a product of the debtor going into bankruptcy but may also occur when the creditors cost of. This implies that some of the credit customers might not pay their debts in time. The debit to bad debts expense would report credit losses of 50000 on the companys June income statement.

A bad debt provision is a reserve made to show the estimated percentage of the total bad and doubtful debts that need to be written off in the next year. The Bad Debts Expense remains at 10000. It is simply a loss because it is charged to the profit loss account of the company in the name of provision.

This shows investors how much receivables are still good. Read more is recorded as a direct loss from defaulters writing off their. Received cash for a bad debt written off last year 2000.

80000 and it is doubtful that the customer may not pay the sum. If instead the allowance for uncollectible accounts began with a balance of 10000 in June we would make the following adjusting entry instead. 70000 written-off as a bad debt being transferred to bad debts.

Not all debtors pay their dues every time. The bad debts expense recorded on June 30 and July 31 had anticipated a credit loss such as this. 1 The entry made in writing off the account is reversed to reinstate the customers account 2 The collection is journalized in the usual manner.

The accounts receivable test is one of many of our online quizzes which can be used to test your knowledge of double entry bookkeeping discover another at the links below. For companies that sell goods and services on credit bad debts are a common occurrence. At times a debtor whose account had earlier been written off by a creditor as a bad debt may decide to make a payment this is called the recovery of bad debts.

However the customers sometimes pay the amount written off as bad debts. Pass Journal entry for sale of goods by Rahul Delhi to Anish Delhi for 10000 less 10 Trade Discount and 2 Cash Discount. Accounting and journal entry for recording bad debts involves two accounts Bad Debts Account Debtors Account Debtors Name.

Iii Goods of 6000 were destroyed by fire and were not insured. You can write off bad debts by clicking Write off in the Collections form and on the Aged balances Customers and Open customer invoices list pages. A contract is a legally enforceable agreement that creates defines and governs mutual rights and obligations among its parties.

Hence these assets need to be written off from the Balance Sheet since they no longer fulfill the asset recognition criteria laid out by assets. Maybe more importantly it shows investors and creditors what percentage of receivables the company is writing off. It is the premier outlet for substantive marketing scholarship.

When a doubtful debt turns into bad debt businesses credit their account receivable and debit the allowance for doubtful accounts. It would be double counting for Gem to record both an anticipated estimate of a credit loss and the actual credit loss. Here is an example of a depreciation journal entry.

Bad debt is debt that is not collectible and therefore worthless to the creditor. Journal of Marketing JM develops and disseminates knowledge about real-world marketing questions useful to scholars educators managers policy makers consumers and other societal stakeholders around the world. In either case the company will recognize it as income for the business.

A contract typically involves the transfer of goods services money or a promise to transfer any of those at a future dateIn the event of a breach of contract the injured party may seek judicial remedies such as damages or rescission. Journal entries to record these facts are given as follows. Balance Sheet or Income Statement Quiz.

Try Another Double Entry Bookkeeping Quiz. This recovered amount may be a partial payment received against the total of the written-off amount or it may be a lower amount agreed with the company for the total written-off amount. Sep 17 2021 Bad debts written off are 1240.

Bad debts provision Bad Debts Provision A bad debt provision refers to the reserve made by a company to set aside an amount computed as a specific percentage of overall doubtful or bad debts that has to be written off in the next year. For the year 2015. The journal entry to record the bad debt recovered is debit cash and credit other income.

2000 due from Sohan became bad debts. It is not directly affected by the journal entry write-off. Below are the examples of provisions for a bad debt journal entry.

Journal Entry for Bad Debts.

Bad Debt Write Off Journal Entry Double Entry Bookkeeping

Bad Debt Overview Example Bad Debt Expense Journal Entries

Journal Entries For Bad Debts And Bad Debts Recovered Youtube

0 Response to "Bad Debts Written Off Journal Entry"

Post a Comment